MFD Website for Mutual Fund Distributors

16 Financial Planning Tools

10 Goal Planning Tools

9 MF Scheme Research

2 Data Collection Tools

Social Media Integration

Login App Connect

MFD Sales & Branding

MF Product & Services

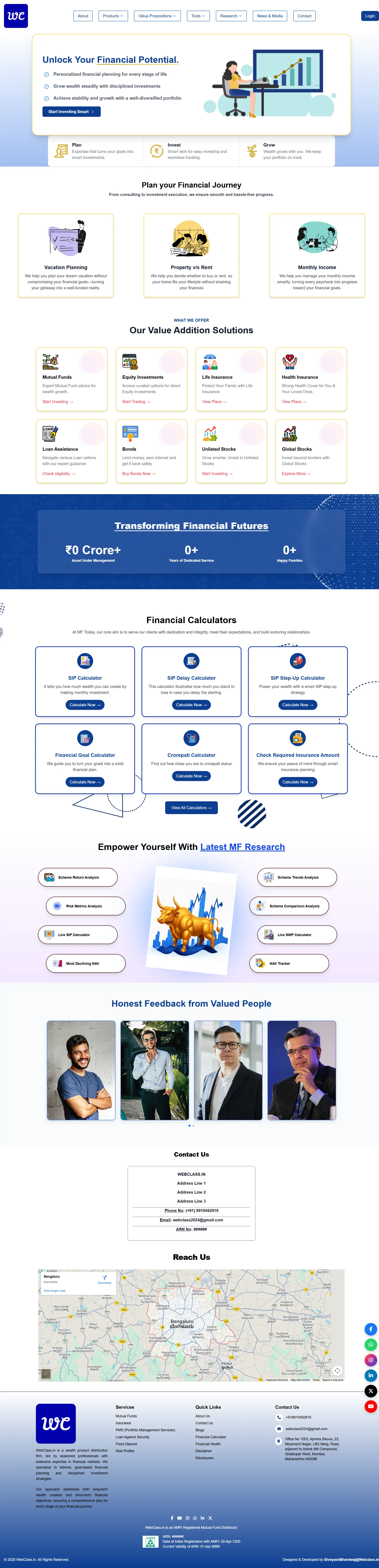

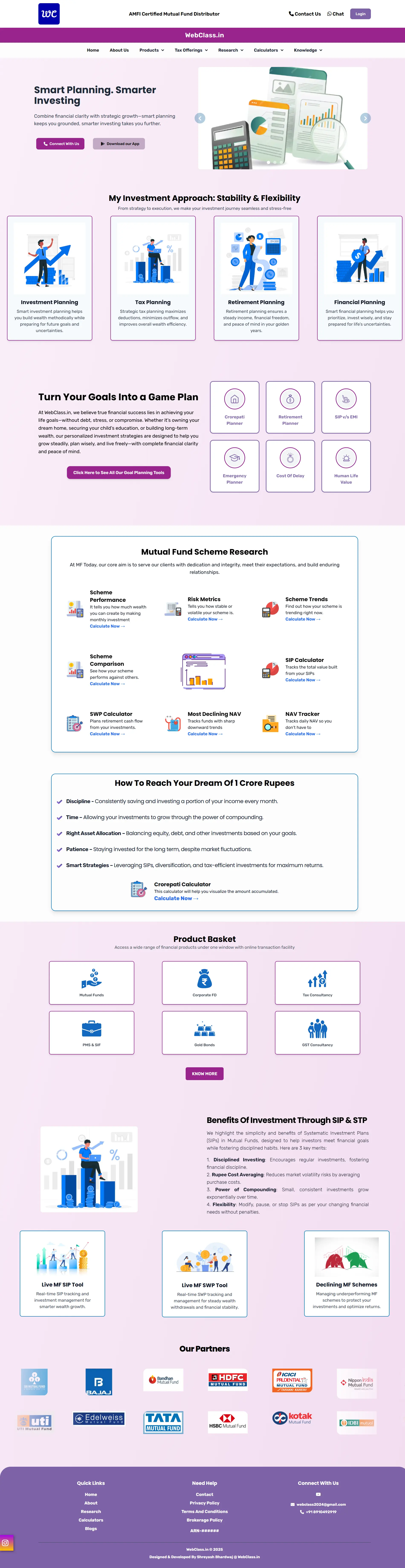

Website Model 1

Website Model 2

Website Model 3

Website Model 4

Website Model 5

Website Model 6

Website Model 7

Website Model 8

Website Model 9